INovember is always the pickle season for owners of photovoltaic systems. The sun only reaches a height that is interesting for the solar modules for a few hours, and the electricity yield drops to a maximum of one fifth of what is usual in summer.

As can be seen from the energy charts of the Fraunhofer Institute for Solar Energy Systems (ISE), the peak value of the solar power production share was around twelve percent on Monday, then quickly fell to five percent in the afternoon and finally to zero – as many Germans do came home and turned on the light.

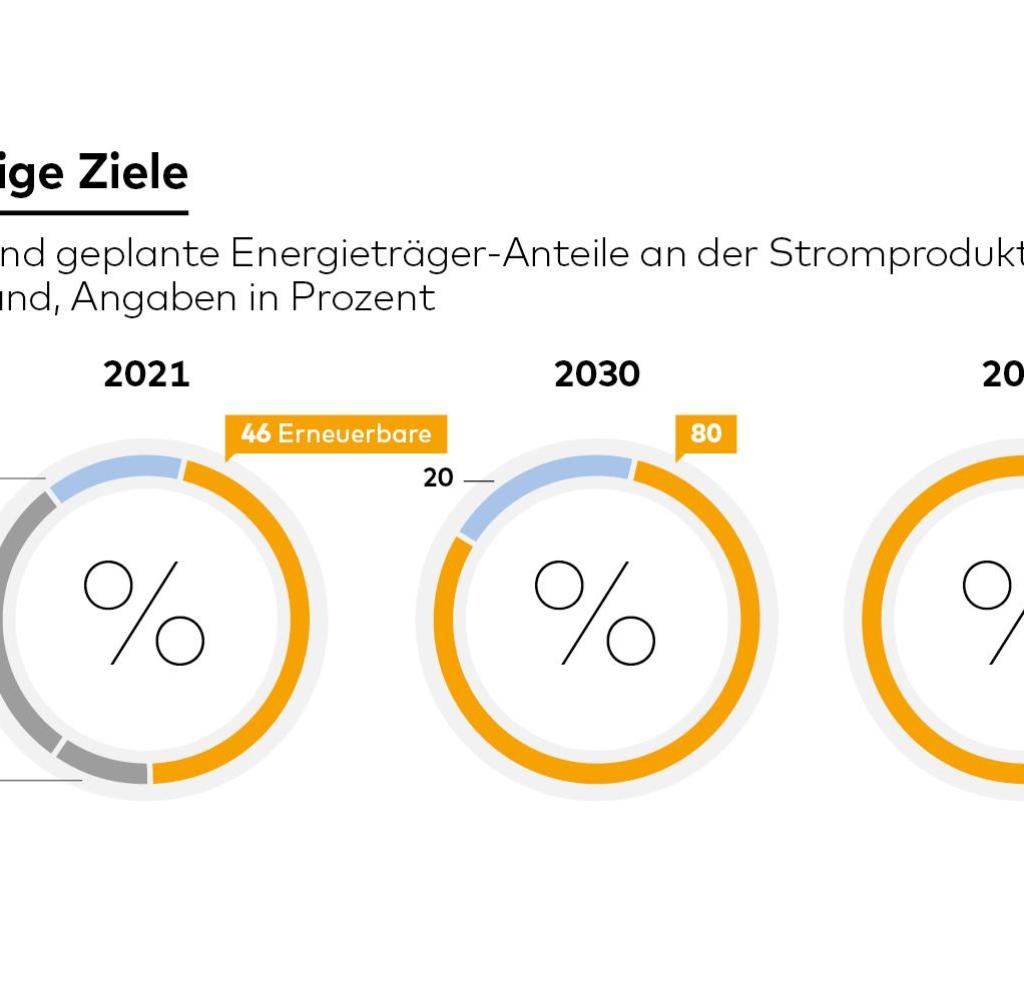

The plans for the future expansion of photovoltaics in Germany look all the more ambitious in the dark season. According to the Renewable Energy Sources Act (EEG), at least 80 percent of the electricity should come from sustainable sources on average by 2030, and the target for 2040 is even 100 percent. And photovoltaics alone are said to have a 40 percent share.

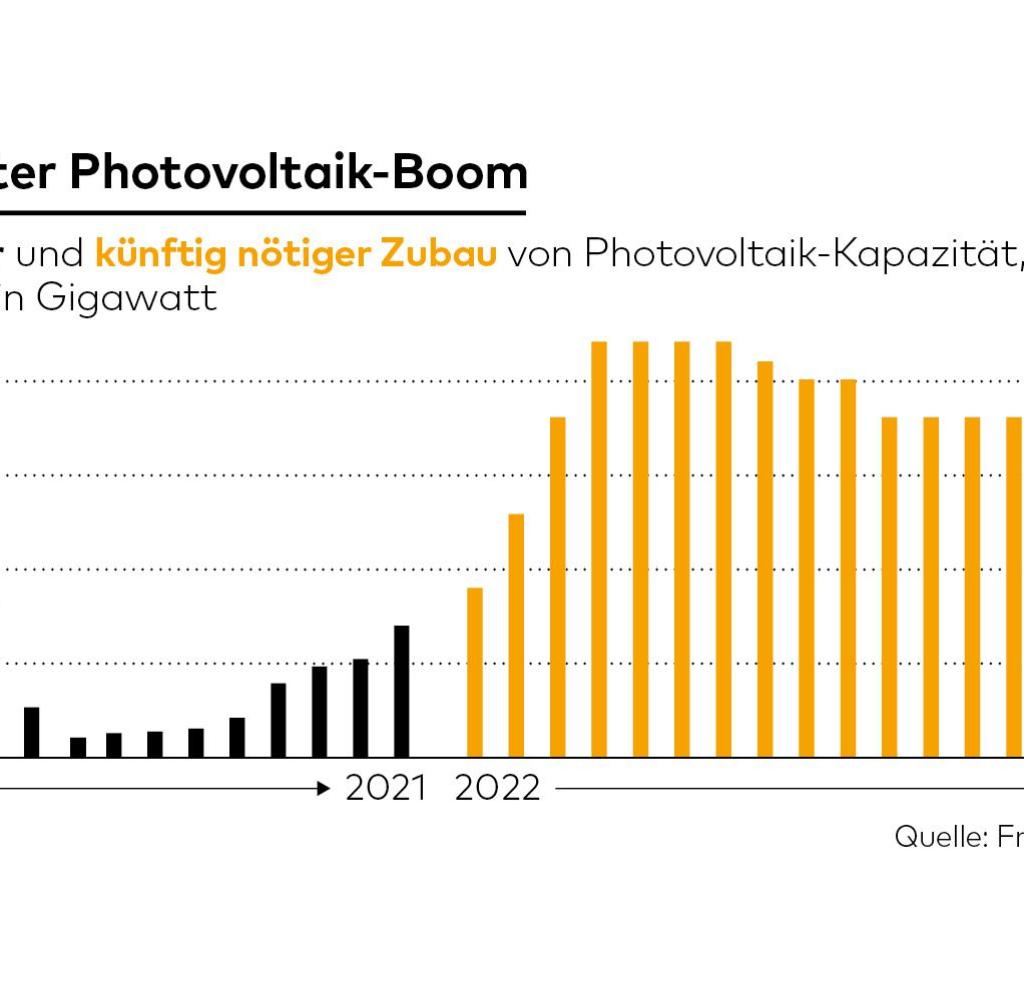

As a recent calculation by the economic consulting firm PriceWaterhouseCoopers (PwC) shows, a tremendous effort is required to achieve these figures. On a long-term average, around 20 gigawatts of additional solar power output would have to be generated every year. That is almost three times as much as in the previous absolute record year 2011, when 7.9 gigawatts of capacity were installed. In the past three years, the average annual increase has not even reached four gigawatts.

According to PwC, around 50 million photovoltaic modules would now have to be installed on German roofs and open spaces every year – modules that have mostly been built in China since the decline of the German solar industry. In the PwC paper, which is available to WELT, the experts warn of renewed dependence in the energy industry. After Russian gas, it would only be Chinese solar modules that Germany would be dependent on in the course of the energy transition.

Source: Infographic WORLD

“If the energy dependency on Russia is not against increasing dependence on China be exchanged, European solar module production must be massively expanded,” says Heiko Stohlmeyer, Director of Renewable Energies at PwC Germany. But that’s a long way to go: because the entire production capacity in the European Union (EU) is currently well below that of individual Chinese suppliers.

A few simple comparisons show this. According to the statistics, the relatively large Italian manufacturer Enel produced PV modules with a volume of 0.2 gigawatts last year. Modules with an output of 8.3 gigawatts came onto the market throughout the EU. If you compare this with Chinese figures, doubts arise about the reliability of the renewable energy strategy. The Chinese manufacturer Jinko alone flooded the market last year with 45 gigawatts of module output.

The energy transition is hanging around the world solar power so from China. According to the PwC list, around 75 percent of all modules came from the People’s Republic last year, and 24 percent from the USA and other countries. And manufacturers from Europe accounted for around one percent of the market share. Germany thus ranks in the per thousand range.

Source: Infographic WORLD

According to the consultants, whether the ambitious energy transition in Germany will succeed depends on the future availability of modules in Germany. In any case, the experts advise a massive expansion of production.

“The expansion of PV in Germany could lead to an annual market volume of around five to seven billion euros for modules alone by the mid-2020s,” says Stohlmeyer. If German manufacturers were also to produce inverters, cabling or transformers, there would be a gigantic “investment in German industrial jobs”, according to PwC.

In addition to the modules, craftsmen are also missing

“According to the German Solar Industry Association (BSW), the number of employees could double within eight years to around 100,000 thanks to the revitalization of the PV industry and thus pick up on previous highs,” says Carl-Maria Bohny, Senior Manager Renewable Energies at PwC Germany.

After all, there has already been an installation push this year. From January to August, 21 percent more solar power capacity was installed than in the same period last year. However, market observers are already seeing the end of the short post-corona boom. photovoltaic component prices have skyrocketed due to supply chain issues, while high cost of living and energy prices are making homeowners and investors wary. The boom could be over before it really started.

But even if enough modules are manufactured – even if it is in China – it remains questionable whether it will be enough craftsmen there to install them. The Central Association of German Electrical and Information Technology Trades (ZVEH) is not even cautiously optimistic: “The organic growth of the past few years, with the enormous increase in tasks due to the energy transition, crisis and digitization, is not sufficient to cover the need for skilled electrical workers”. , the association announced on request.

After all, the electrical trade companies are not only in demand in the photovoltaic sector, but also in the installation of heat pumps, storage and networked energy management systems as well as charging infrastructure for e-mobility. There is currently a lack of around 81,000 trained specialists in the electrical trades. “And this despite the fact that the industry has been growing successfully for years – both in terms of skilled workers and trainees.”

The hope of the association now rests on the fact that, on the one hand, a good half of the 50 million modules required each year will not be installed on roofs, but in open spaces. That would then be a task for “energy suppliers and corporations”. In order for companies to have planning security, politicians would have to create better conditions. A solar roof requirement in new buildings, for example, could contribute to this.

“Everything on shares” is the daily stock exchange shot from the WELT business editorial team. Every morning from 7 a.m. with our financial journalists. For stock market experts and beginners. Subscribe to the podcast at Spotify, Apple Podcasts, Amazon Music and deezer. Or directly by RSS feed.